Terra and Abracadabra Team Up to Challenge Centralized Stablecoins

For an industry that has decentralization in its very name, DeFi’s reliance on centralized stablecoins remains an Achilles’ heel, making it an easy target for overzealous regulators.

By: yyctrader • Loading...

DeFi

For an industry that has decentralization in its very name, DeFi’s reliance on centralized stablecoins remains an Achilles’ heel, making it an easy target for overzealous regulators.

On October 16, Terra and Abracadabra announced a partnership that aims to take on the incumbents by leveraging their UST and Magic Internet Money (MIM) stablecoins.

Details of the partnership haven’t been announced yet but could potentially include MIM-UST liquidity pools and LUNA collateral, allowing users to borrow MIM against their LUNA tokens.

“Decentralised Yields require a pair, $MIM and $UST are the power couple of Stablecoin Yields,” Abracadabra founder Daniele told The Defiant.

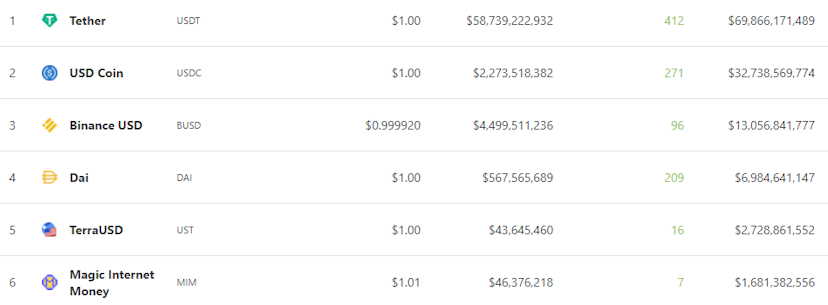

Custodial stablecoins USDT, USDC and BUSD comprise 87% of the $133B in stablecoins currently in circulation, and the real number is even higher when we consider that DAI is partially collateralized by USDC.

Algo-stable Meets CDP

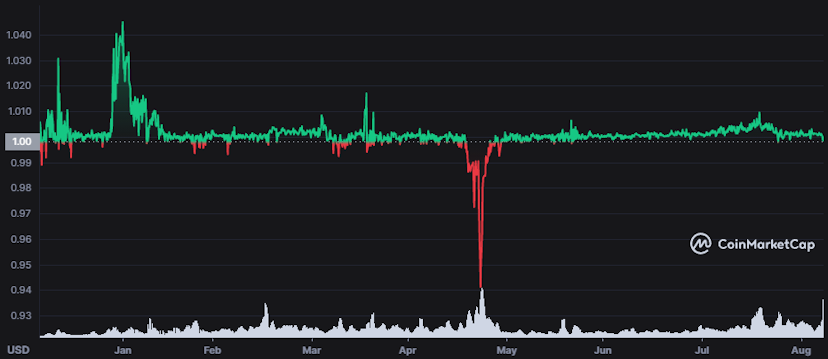

UST is an algorithmic stablecoin that is collateralized by Terra’s LUNA token. One UST can always be redeemed for $1 worth of LUNA, and the system has proven to be quite resilient, recovering quickly from a dip under its peg during the May crash.

Growing adoption has propelled it to a market cap of nearly $3B as the fixed yields offered on Anchor Protocol have become popular with DeFi users.

Magic Internet Money (MIM) is an overcollateralized stablecoin similar to MakerDAO’s DAI. Users are able to deposit various crypto assets and borrow up to 90% of their value in MIM. Centralized stablecoins indirectly comprise some of MIM’s collateral through the Curve pools but to a much smaller extent than DAI.

Borrowing markets are currently available on Ethereum, Avalanche, Fantom and Arbitrum. Bridging MIM across supported blockchains is free using the Anyswap-powered MIM Bridge and users only incur gas costs, though this may change in the future as fees are added.

MIM’s focus on yielding assets as collateral opens up some interesting leveraged yield farming opportunities. Recursively farming Curve’s tricrypto and 3pool through Convex Finance for additional market exposure while earning lucrative CRV and CVX rewards is a popular strategy.

Tokens Swapped

Although details of the swap are yet to be officially announced, The Defiant was told by sources close to the deal that it’s in the mid-to-high seven figures.

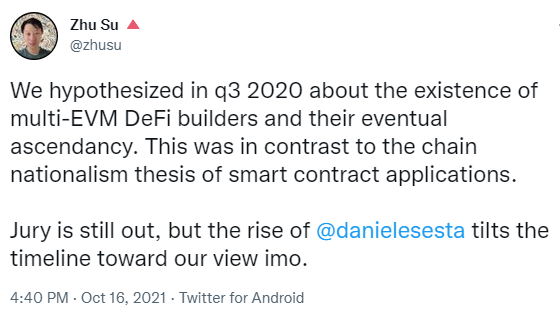

Su Zhu, the founder of crypto hedge fund Three Arrows Capital, seems to approve.

Disclosure: The author holds positions in SPELL and LUNA.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.