Aave Floats New Plan To Restore GHO Peg

Liquidity Committee To Actively Manage GHO Liquidity Using Maverick Protocol

By: yyctrader • Loading...

DeFi

Aave’s GHO stablecoin has consistently traded below its intended $1 peg since launching in July.

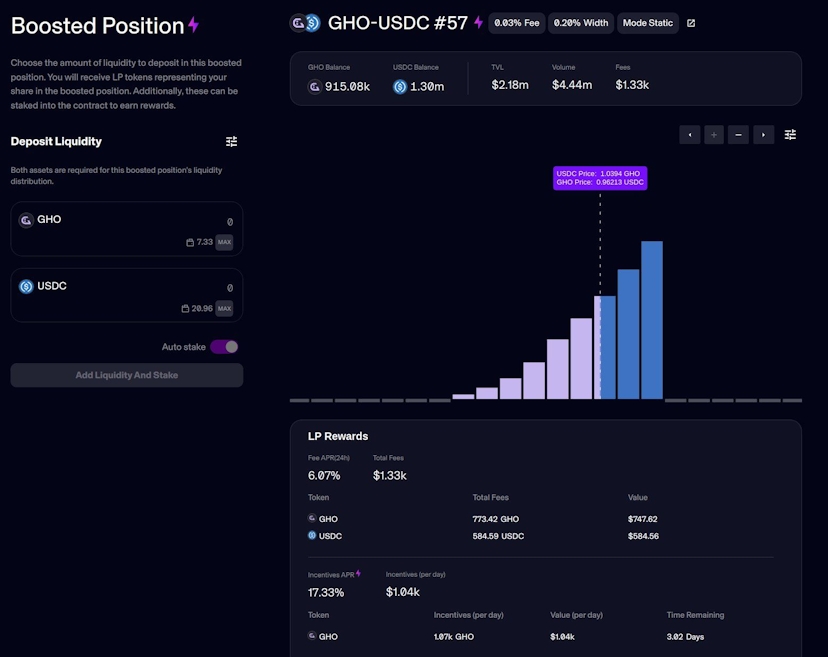

On Oct. 31, TokenBrice, a member of Aave’s Liquidity Committee, unveiled a plan to ‘gently nudge’ GHO back to its peg using actively managed liquidity on Maverick Protocol and other DeFi platforms.

The Committee will leverage Maverick’s novel static pools to enforce buy/sell walls within a specific price range, gradually moving GHO toward its peg. Maverick is an automated market maker (AMM) that allows liquidity providers a high degree of customization and introduced the concept of 'directional LPing.'

GHO is a stablecoin native to the Aave protocol, allowing users to mint it using a wide range of collateral.

However, the interest rate for GHO is determined by governance, and there is currently no mechanism in place to adjust it according to changing market conditions. This lack of flexibility has caused GHO's borrowing rate to remain below alternative options, such as borrowing DAI on Maker or other stablecoins on leading money markets.

This rate discrepancy has created an arbitrage opportunity, where AAVE stakers, who enjoy lower borrowing costs for GHO, can borrow GHO, swap it for DAI, and earn the DAI Saving Rate, currently at 5%.

Another factor contributing to GHO's struggle to maintain its peg is the absence of good yield options for GHO. Competing stablecoin farms like Liquity's LUSD Stability Pool or MakerDAO's DAI Saving Rate have been successful in attracting holders who choose to keep the stablecoin instead of swapping it for alternatives. However, GHO currently lacks a similar utility, which results in borrowers swiftly selling their GHO for other stablecoins that offer higher yields.

Aave governance is considering adding wGHO as collateral on Aave and providing a staking option, which could incentivize users to hold GHO. These initiatives, coupled with the efforts to adjust the interest rate, aim to stabilize GHO at $1.

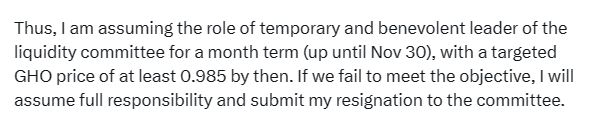

TokenBrice has been appointed to temporarily lead the Committee with a GHO target of $0.985 by November 30.

Corrected on 11/1 to reflect that Maverick is an independent AMM.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.