Aave Closes In On Zero Token Incentives While Borrowing Surges

“We don’t need it anymore,” said Marc Zeller, founder of the Aave Chan Initiative.

By: Pedro Solimano • Loading...

DeFi

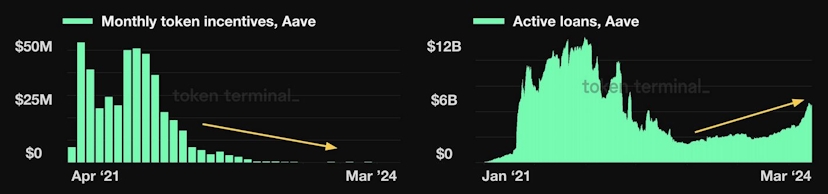

Aave is about to achieve the Holy Grail of tokenomics as the token incentives on the Decentralized Finance (DeFi) lending platform are about to drop to zero while activity continues to climb.

According to TokenTerminal, monthly token incentives – additional yield in AAVE tokens that originate from the Aave Reserve, used primarily to incentivize specific actions – have been downtrending since late 2021. AAVE token incentives are down 37% from their peak in Dec. 2023 of $335,000 to $214,000 in March 2024.

Incentives spiked 137% in the past 30 days, however, reaching $225,000.

Active loans on the platform, on the other hand, are on a consistent uptrend, notching a 31% increase over the past 30 days, reaching $5.7 billion, the highest since June 2022.

Aave dominates the lending sector in terms of loans outstanding by a wide margin.

According to DeFiLlama, Compound Finance lands in second place, with $971 million borrowed; Morpho claims third with $959 million; Spark ranks fourth, with $588 million; and Venus rounds out the top 5 with $568 million in outstanding loans.

“We don’t need [token incentives] anymore,” said Marc Zeller, founder of the Aave Chan Initiative (ACI). “After four years, people realized it’s better to use Aave and not lose money in a hack,” he told The Defiant.

Aave initially launched its native token, LEND, in Nov. 2017, but executed its transition to AAVE in Oct. 2020. To limit the amount of new AAVE entering the system, the system’s total supply is capped at 16 million, with the token trading for $129 after an 8% jump today.

Alternative Token Structures

Token incentives for other top DeFi protocols differ slightly from Aave’s.

Compound Finance distributes a portion of its protocol fees to COMP token holders in the form of COMP tokens, but unlike Aave doesn’t have a separate pool for additional incentives.

Morpho offers a triple incentive structure, rewarding users for trading, liquidity mining, and boosting rewards (users need to lock in their MORPHO tokens to boost earnings through other rewards systems in the protocol).

What Comes Next

The move now is to implement a profit share switch, said Zeller. He explained that this is different from a fee switch “because Aave has been making money since day one.” Instead, ACI will propose to distribute the platform’s net profit, with a DAO-centric rewards system.

Net revenue for the platform, according to DefiLlama, sits at $129 million, with Aave V3 holding $8.8 billion in total value locked. That ranks it in top place in the lending sector, ahead of JustLend with $7.6 billion, which briefly overtook Aave in Nov. 2023.

Stani Kulechov, Aave’s creator, touted the aforementioned numbers on X, posting that, “The reason is simple: Aave built the best product for users,” adding that they “didn’t build for the narrative or for the VCs.”

Next up for Aave is the ongoing Merits program, which went live on March 19 and aims to airdrop $5 million to wETH borrowers over the next 90 days.

Proposed by Zeller on Feb. 16, Merits is a new Aave-Alignment User Reward System designed to prioritize the Aave DAO. It targets its competitors such as Morpho – which Zeller called “a leech on top of Aave” – thanks to its focus on the DAO.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.