Aave Aims for a Seamless DeFi With Flash Loan-Driven V2

Aave’s Aims for a Seamless DeFi With Flash Loan-Driven V2 Aave, the third-largest DeFi lending protocol by assets, today unveiled its V2 revamp, where it leverages flash loans to make DeFi more seamless and composable. Aave’s V2 includes several enhancements of its lending products, many of which are powered by flash loans. Flash loans don’t…

By: Camila Russo • Loading...

DeFi

Aave’s Aims for a Seamless DeFi With Flash Loan-Driven V2

Aave, the third-largest DeFi lending protocol by assets, today unveiled its V2 revamp, where it leverages flash loans to make DeFi more seamless and composable.

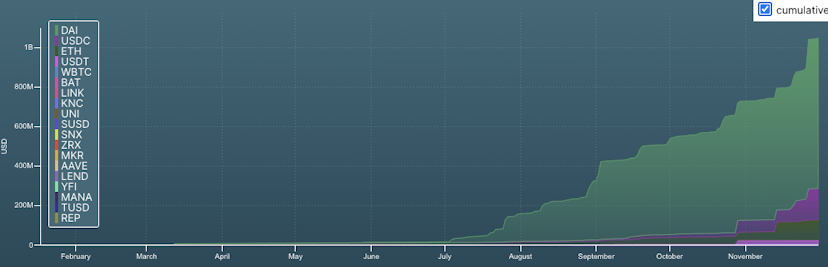

Aave’s V2 includes several enhancements of its lending products, many of which are powered by flash loans. Flash loans don’t require any initial capital as long as the they’re paid back within the same blockchain block. Flash loans on Aave, which this month crossed the $1B mark, have been often behind financial exploits to DeFi protocols. Aave’s upgrade shows other ways flash loans can be used by investors.

Aave’s flash loans. Image source: aavewatch.com

Collateral Swap

One of the main innovations of the upgrade is the ability for users to swap the underlying collateral of their loans —a move that’s powered by flash loans. Users can swap their collateral to avoid liquidations by swapping out an asset whose value is falling, with another asset. Traders can also swap their collateral out and exchange it for another asset if it could be better used to earn yield elsewhere.

“In DeFi, assets that were being used as collateral were tied up, but now with V2 they are free to be traded,” Aave’s blog post said.

Flash loans are also used to close out loan positions by paying directly with collateral in one transaction, and for traders to flash borrow capital to execute a liquidation. Aave also introduced, Batch Flash Loans, which lets developers borrow multiple assets inside the same transaction.

“This means a Flash-borrower can access virtually all the Protocol liquidity,” the blog post said. This should empower borrowers, but it also gives those looking to exploit DeFi protocols even more fire power.

Credit Delegation

Aave’s V2 is taking steps to make undercollateralized loans via credit delegation more accessible. The concept, which was released in July, consists on having a depositor transfer borrowing power based on the collateral they have in the protocol, over to a borrower. The mechanism has been executed in a centralized way.

Now, Aave has built the rails for it to be done natively on the protocol. One important step was to tokenize debt —borrowers receive tokens representing their loans. Next, developers will have to continue building out the interface and mechanism for this feature to become more accessible and safer to do.

With Aave V2, borrowers can have both a stable borrow position and a variable borrow position at the same time, with the same underlying asset, from the same wallet.

Aave, which originally was ETHLend, relaunched its protocol this year, increasing its total value locked from less than $500k to over $1.5B.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.