1% of Bitcoin Supply is Now Wrapped onto Ethereum

They just couldn’t resist. Many Bitcoin diehards disdain other digital tokens but when it comes to capturing yields it’s hard not to embrace Ethereum’s DeFi ecosystem. With wrapped Bitcoin’s total supply at 187,610, the leading form of Bitcoin on Ethereum constitutes over 1% of BTC’s overall supply which stands at 18.729M at the time of…

By: Owen Fernau • Loading...

DeFi

They just couldn’t resist.

Many Bitcoin diehards disdain other digital tokens but when it comes to capturing yields it’s hard not to embrace Ethereum’s DeFi ecosystem.

With wrapped Bitcoin’s total supply at 187,610, the leading form of Bitcoin on Ethereum constitutes over 1% of BTC’s overall supply which stands at 18.729M at the time of writing.

The development attests to Bitcoin’s usefulness in the DeFi ecosystem, where in its wrapped form, known as WBTC, users can generate a return by providing WBTC liquidity in automated market makers, depositing in yield aggregator’s vaults, borrowing against the asset as collateral, or other creative financial means.

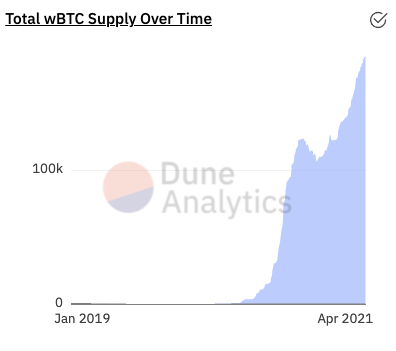

WBTC’s growth has been stunning, with total supply rising from roughly 4,000 in June, to its current level almost 47 times larger a year later.

Image source: Dune Analytics

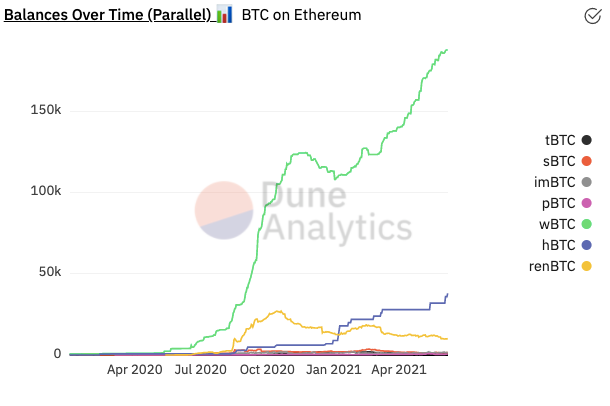

Despite competition from other forms of wrapped Bitcoin like exchange Huobi’s HBTC, WBTC appears to be running away from a largely stagnant competition. HBTC has a 37.9K supply, according to Defi Pulse.

Image Source: Dune Analytics

RenBTC, which takes a less centralized approach to custodying native BTC, has seen its supply slide since a high in October of last year.

BadgerDAO Rises

BadgerDAO, which aims to build the “products and infrastructure to bring Bitcoin to DeFi,” has played a role in WBTC’s success.

BadgerDAO currently has nine “setts,” which are places to put your WBTC, available to users with $505.3M total value locked. As many of the setts are actually liquidity pairs involving WBTC and some other asset, not all the locked value is WBTC.

Still, BadgerDAO’s leading vault is its WBTC exclusive vault developed in partnership with Yearn Finance, the yield aggregator. The teams behind the projects uncapped the vault’s deposits in early May, leading to the 5,158 WBTC, worth $174M, deposited today.

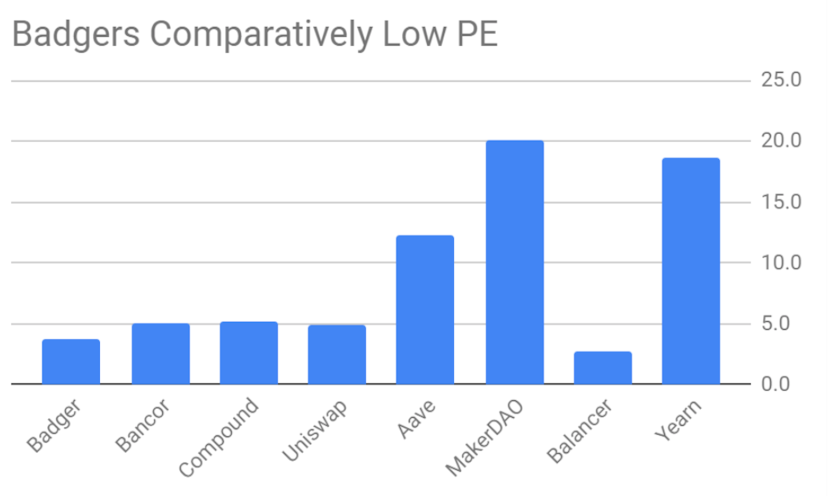

BadgerDAO recently released a report depicting its relatively low price-to-earnings ratio, perhaps suggesting the protocol is underrated, demonstrating that its use of WBTC can turn into a viable DeFi business.

Image source: BadgerDAO

With BTC down 42.5% in the past 30 days at the time of writing, it will be interesting to watch what Bitcoin holders will do if a bear market truly takes hold.

If the increasing supply of WBTC is any indication, it appears that investors will continue to seek yield, perhaps even more so, in DeFi during what may be the beginning of another crypto winter.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.